Urban redevelopment tax incentives clear first round

Businesses that locate or expand in urban areas with high poverty and unemployment rates could receive tax incentives under a proposal advanced from the first round of debate March 23.

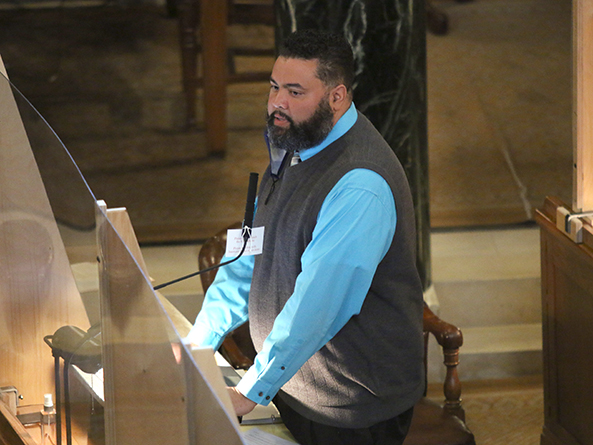

Under LB544, introduced by Omaha Sen. Justin Wayne, taxpayers could apply to the state Department of Economic Development for tax incentives based on their level of investment and the number of new employees they hire.

Qualifying businesses would be located in an economic redevelopment area in which the average rate of unemployment is at least 150 percent of the state average and the average poverty rate is 20 percent or more for the federal census tract in the area.

Wayne said the bill would incentivize small business development in the “poorest of our poorest areas,” particularly north and south Omaha and parts of Lincoln.

He said available lots in those areas are too small to attract the large projects that could qualify for tax incentives under the ImagiNE Nebraska Act. LB544 is meant to encourage smaller projects suited to those sites, Wayne said.

The bill would create two tiers under which taxpayers could earn credits.

Upon approval, an applicant would receive a credit under the first tier if they invest at least $150,000 in qualified property and hire at least five new employees before the end of a two-year period. They also would have to pay a minimum qualifying wage of 70 percent of the Nebraska statewide average hourly wage to new employees.

Taxpayers would receive $3,000 per new employee or $4,000 if the employee lives in an economic redevelopment area. They also would receive $2,750 for each $50,000 in property investment.

Under the second tier, an applicant would receive a credit equal to five percent of their investment in qualified property if they invest at least $50,000.

Taxpayers could use the credits to offset income, sales and use or real property taxes. No taxpayer could earn a credit greater than $50,000.

The bill would limit total incentives to $8 million, and no new applications could be filed after Dec. 31, 2031. Beginning Sept. 1, 2024, the department would present an annual report on the program to the Legislature.

The state Department of Revenue estimates that the bill would reduce state general fund revenue by $1.4 million in fiscal year 2021-22, $3.5 million in FY2022-23 and $3.7 million in FY2023-24.

Sen. Terrell McKinney of Omaha supported the bill. LB544 would benefit his district, he said, which has the highest poverty rate in Nebraska as well as high unemployment, low investment and low median income.

“I believe it’s time to start investing in people and small businesses in communities like mine,” McKinney said.

Senators voted 45-0 to advance the bill to select file.