ADC child support income exclusion advanced

Lawmakers amended and advanced a bill April 3 that would exclude some child support income in determining eligibility for a government assistance program.

Under current law, eligibility for the Temporary Assistance for Needy Families, Low-Income Home Energy Assistance, Supplemental Nutrition Assistance and Child Care Subsidy programs are determined by the applicant’s household income that includes income received through child support payments made by the non-custodial parent.

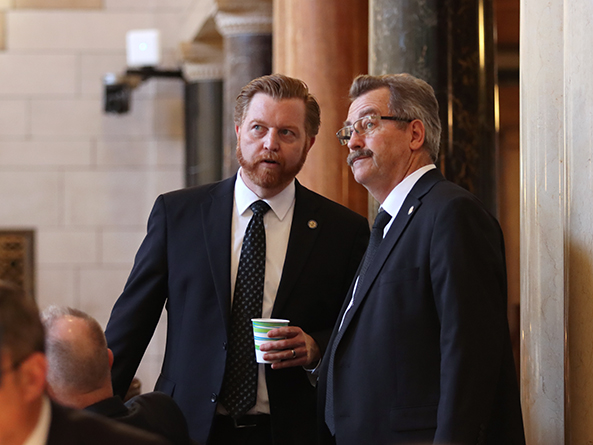

LB233, as introduced last session by Omaha Sen. John Cavanaugh, would require the state Department of Health and Human Services to disregard all child support income for purposes of calculating a recipient’s eligibility for assistance through TANF, LIHEAP, SNAP and the Child Care Subsidy program, beginning Jan. 1, 2024.

The bill also would remove a current provision of the state’s TANF direct cash assistance program, Aid to Dependent Children, that requires recipients to surrender all child support payments to the state in order to receive benefits. Under LB233, child support payments made to a custodial parent receiving ADC benefits would go directly to the parent rather than to the state.

Cavanaugh said the current practice is unfair.

“When a parent pays money for the support of their child, the state should not take that money,” he said. “That money should go [toward] the support and welfare of the child.”

A Health and Human Services Committee amendment, adopted 41-0, would limit the income disregard to the ADC program.

Cavanaugh introduced an amendment to the committee amendment that would change the bill’s operative date to July 1, 2026. It also would create a pass-through to allow a custodial parent to receive $100 of child support paid for a family with one child and $200 for a family with two or more children and disregard that amount when determining program eligibility.

Lincoln Sen. Danielle Conrad spoke in support of the measure. She said just 30% of taxpayer dollars that come to the state through the TANF program and are intended to support low-income families in Nebraska are being used for that purpose.

“That’s problematic in a lot of respects,” Conrad said. “But this is one common sense issue that I think we can come together on and find consensus to at least make sure that the state of Nebraska stops ripping off child support payments for low-income working families in the administration of this program.”

Following the 41-0 adoption of Cavanaugh’s amendment, senators voted 38-0 to advance LB233 to select file.