Session Review: Revenue

The Revenue Committee advanced bills this session creating an array of tax credits, allowing businesses to deduct certain expenses immediately and authorizing cities to use local tax revenue to pay for the development of special retail districts.

Property tax relief

Lawmakers passed over Gov. Jim Pillen’s property tax relief proposal on final reading without voting on it.

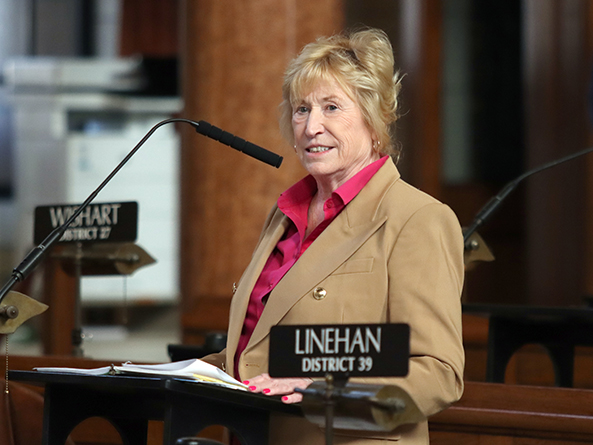

LB388, as introduced by Elkhorn Sen. Lou Ann Linehan, would have made a technical change to state law regarding the sales tax rate.

A committee amendment would have replaced the bill with a proposal to increase the state sales tax rate, impose sales tax on the purchase of certain items and services and eliminate exemptions for others. The additional revenue would have been used to provide property tax relief.

A select file amendment replaced the bill with a proposal retaining many of the committee amendment’s provisions but leaving out the proposed rate increase.

As amended, the bill would have ended the refundable income tax credit against school taxes paid that was created under LB1107 in 2020. It instead would have “frontloaded” the funds allocated to the program by disbursing them to counties, which then would have credited each parcel based on the school district taxes levied. The credit would have appeared on the parcel’s property tax statement.

LB388 also would have limited the annual increase in a political subdivision’s property tax request authority to no more than 3% or the percentage change in the consumer price index, whichever was greater, in addition to a percentage based on the increase in the political subdivision’s total property valuation due to new construction and other improvements to real property. Several exceptions to the limit would have applied.

At Linehan’s request, Speaker John Arch of La Vista passed over LB388. The Legislature moved to the next item on the agenda without voting on the bill, ending debate on it this session.

Tax credit package

The committee advanced a bill creating several new tax credits, including one to help Nebraskans offset expenses they incur when caring for a family member.

Under LB937, introduced by Lincoln Sen. Eliot Bostar and passed 45-0, a family caregiver is eligible for a nonrefundable income tax credit equal to 50% of expenses incurred that are directly related to the care for and support of an eligible family member.

Total credits are limited to $1.5 million in fiscal year 2025-26 and FY2026-27 and $2.5 million in the following years.

As amended, LB937 contains provisions of several other bills considered by the committee this session.

Under the provisions of LB901, introduced by Linehan, purchases made by a nonprofit organization are exempt from state sales and use tax if the nonprofit acquires property or contracts to build, improve or repair property that will be transferred to a nonprofit whose purchases already are exempt.

The amended provisions of LB1002, sponsored by Sen. Tom Brandt of Plymouth, set the maximum amount of tax credits available under the Nebraska Biodiesel Tax Credit Act at $1 million in FY2024-25 and $1.5 million in the following years.

Under the amended provisions of LB1022, introduced by Bellevue Sen. Rita Sanders, film and television production companies may apply for a refundable income tax credit equal to at least 20% of their qualifying expenditures attributable to the production of films, documentaries and other projects in Nebraska.

The state Department of Economic Development may approve no more than $500,000 in credits in FY2025-26 and $1 million in the following years.

The amended provisions of LB1025, introduced by Bostar, create the Individuals with Intellectual and Developmental Disabilities Support Act.

The provisions allow qualifying direct support professionals who care for individuals with intellectual and developmental disabilities to claim a refundable state income tax credit.

Employers of direct support professionals can claim a new nonrefundable credit, as can employers that either employ an individual receiving services pursuant to a Medicaid home and community-based services waiver or provide certain services to an individual pursuant to such a waiver.

The state Department of Revenue may approve a total of $1 million in credits in FY2025-26, $1.5 million in FY2026-27 and $2 million in later years.

Under a bill passed last session, grocery stores, restaurants and agricultural producers may apply for a nonrefundable state income tax credit equal to 50% of the value of food they donate to food banks, pantries or rescues, up to a maximum of $2,500.

Under the provisions of LB1040, introduced by Sen. John Fredrickson of Omaha, the department may approve $500,000 in credits each fiscal year beginning in FY2025-26.

The amended provisions of LB1072, sponsored by Lincoln Sen. George Dungan, allow a producer or importer of sustainable aviation fuel to claim a nonrefundable income tax credit based on the number of gallons in all sold or used qualified mixtures. The department may approve $500,000 in credits each fiscal year.

Under the amended provisions of LB1084, introduced by Sen. Teresa Ibach of Sumner, a Class III shortline rail company located wholly or partly in Nebraska can apply to the department for a nonrefundable tax credit equal to 50% of its qualified maintenance expenditures during the tax year.

The credit amount cannot exceed $1,500 per mile of track. The department may approve no more than $500,000 in credits in FY2025-26 and $1 million in later years.

Under the provisions of LB1158, sponsored by Bostar, the state treasurer will contract with a medical debt relief coordinator to purchase and discharge medical debt of eligible residents.

Nebraska residents with a household income at or below 400% of the federal poverty guidelines or with medical debt equal to at least 5% of the individual’s household income qualify. Contributions to the program’s fund are deductible for state income tax purposes.

Under the amended provisions of LB1184, introduced by Bostar, Nebraska taxpayers can apply to the department for a one-time, refundable state income tax credit of up to $1,000 to offset the cost of installing a reverse osmosis system at their primary residence if test results show high levels of nitrates, uranium or certain chemicals in the drinking water.

The department may approve a total of $500,000 in credits in FY2024-25 and the following two fiscal years and $1 million in later years.

The amended provisions of LB606, introduced last session by Thurston Sen. Joni Albrecht, allow individuals, passthrough entities, corporations, estates and trusts to claim a nonrefundable credit of up to 50% of their state income tax liability on contributions they make to qualifying pregnancy help organizations.

Total credits are limited to $500,000 in FY2025-26 and $1 million in FY2026-27 and later years.

Provisions of Brandt’s LB1047 expand the list of denaturants subject to an excise tax paid by ethanol producers and impose the tax on 2% of certain agricultural ethyl alcohol sold that is unfit for beverage purposes.

Finally, provisions of LB58, introduced last session by Sen. John Cavanaugh of Omaha, exempt diapers from state sales and use tax.

Omnibus bill

LB1317, sponsored by Linehan, was introduced as a placeholder. As amended, it contains the provisions of several other bills heard by the committee this session.

The provisions of LB863, also introduced by Linehan, eliminate an income tax deduction for amounts received as annuities under the Federal Employees Retirement System.

Under provisions of LB893, sponsored by Ibach, business equipment involved in the manufacturing or processing of liquid fertilizer or any other chemical applied to crops — or the manufacturing of any liquid additive for a farm vehicle fuel — qualify for a property tax exemption under the ImagiNE Nebraska Act.

The amended provisions of LB1043, introduced by Omaha Sen. Terrell McKinney, require certain nonprofit organizations that own or acquire underutilized tax-exempt property in a high-poverty area to develop the property within three years.

The amended provisions of LB1093, sponsored by Bostar, update the First Responder Recruitment and Retention Act, which provides tuition assistance to qualifying first responders.

The provisions expand and clarify the definition of first responder to include any law enforcement officer and professional firefighter.

They also, with certain exceptions, prohibit an employer from canceling a first responder’s individual or family health insurance policy if the first responder suffers serious bodily injury from an event that occurs while the first responder is acting in the line of duty.

Under the amended provisions of LB1134, introduced by Sen. R. Brad von Gillern of Elkhorn, interest on refunds and additional taxes due as a result of a decision on a property’s valuation by the Tax Equalization and Review Commission will begin to accrue 30 days after the decision.

The provisions also allow two commissioners to constitute a quorum to hear and determine appeals or petitions.

Provisions of Bostar’s LB1184 state legislative intent to appropriate $1 million in general funds for FY2024-25 to the state Department of Environment and Energy to fund the installation of real-time nitrate sensors in monitoring wells.

The amended provisions of LB1217, also sponsored by Bostar, update requirements for owners of rent-restricted housing projects and change how county assessors calculate valuation for those projects. They also allow the owner of a sales-restricted house to apply to the county assessor for a special valuation.

Under the provisions, certain nursing and assisted living facilities will receive a property tax exemption based on the percentage of occupied beds provided to Medicaid beneficiaries. LB1317 also applies a property tax exemption to the commons area of a building that is owned by a charitable organization and used for student housing.

The amended provisions of LB1218, introduced by Bostar, impose an excise tax of 3 cents per kilowatt hour on the electricity used to charge electric and plug-in hybrid electric vehicles at a commercial electric vehicle charging station, beginning Jan. 1, 2028.

They also increase the additional registration fee for each motor vehicle powered by an alternative fuel from $75 to $150. The additional fee for a plug-in hybrid electric vehicle is $75.

Under LB1317, an electric supplier may own, maintain and operate a direct-current, fast-charging station for retail services only at a location that is at least 15 miles from a privately owned station and at least one mile from a federally designated alternative fuel corridor.

An electric supplier is required to conduct a right of first refusal process before beginning construction of a fast-charging station.

Those requirements for electric suppliers end Dec. 1, 2027. Effective Jan. 1, 2028, an electric supplier cannot operate a fast-charging station within 10 miles of a privately owned station that already is in operation or has a building permit and interconnection request to the electric supplier.

The provisions of LB1295, sponsored by von Gillern, create the Financial Institution Data Match Act. The measure requires the state Department of Revenue to operate a data match system with each financial institution doing business in Nebraska.

Under the system, the department will provide financial institutions a list of individuals with unpaid taxes that the institutions will match to their account records. Institutions will provide the department with a list of all matches.

Provisions of LB1305, sponsored by Blair Sen. Ben Hansen, expand the definition of bullion and add or subtract net capital gains or losses to or from federal adjusted gross income, unless the gain or loss is derived from the sale of bullion as a taxable distribution from a retirement plan account.

The Good Life Transformational Projects Act, passed by the Legislature last year, authorizes the state Department of Economic Development to approve applications for “good life districts” that meet certain thresholds related to investment and job creation. Transactions within a district are subject to a reduced state sales tax rate of 2.75%.

Under the provisions of LB1374, introduced by Linehan, a city may — with voter approval — establish an economic development program for an area of the city included in a good life district and appropriate local sources of revenue to pay for development costs.

The provisions of LB1389, sponsored by Bostar, exempt broadband equipment from personal property tax if it is deployed in an area using federal Broadband Equity, Access and Deployment program funds or in a qualified census tract located in a metropolitan class city and used to provide internet access at certain speeds.

The provisions of LB1397, introduced by Sen. Dave Murman of Glenvil, exclude land used for commercial purposes that are not agricultural or horticultural — such as land used for a solar farm or wind farm — from the definition of agricultural and horticultural land for valuation purposes.

LB1317 also makes changes intended to improve the accuracy of currently required reports on inheritance tax collected by counties and creates a collection system to intercept an individual’s gambling winnings to pay off any child support debts or unpaid taxes.

Finally, the bill allows a publicly owned stadium in a metropolitan class city to qualify for state assistance under the Sports Arena Facility Financing Assistance Act.

LB1317 passed on a vote of 49-0 and took effect immediately.

Other measures

The committee advanced a bill intended to incentivize Nebraska businesses to invest in new equipment and technology.

The 2017 Tax Cuts and Jobs Act enacted by Congress allowed businesses to fully and immediately deduct expenses for certain business machinery and equipment, as well as research or experimental expenditures. Those two tax breaks have since expired, requiring businesses to deduct their expenditures over a period of several years.

Under LB1023, introduced by von Gillern and passed 49-0, state income tax deductions for business assets and research or experimental expenditures are allowed beginning with tax year 2026. The former deduction is limited to 60% of the cost of expenditures for certain business assets in the tax year in which the property is placed in service.

LB1023 includes provisions of five other bills heard by the committee this session, including two that relate to income earned by nonresidents.

Under the amended provisions of LB173, sponsored by Bostar, and LB416, introduced by Omaha Sen. Kathleen Kauth, compensation paid to a nonresident individual does not constitute income derived from sources within Nebraska under certain conditions.

The provisions of LB1049, also sponsored by Bostar, decrease from 6.25% to 4% the maximum occupation tax on receipts from the sale of telecommunications service beginning Oct. 1, 2024.

Under the amended provisions of LB1113, introduced by Sen. Fred Meyer of St. Paul, business equipment used primarily for the capture and compression of carbon dioxide is eligible for a personal property tax exemption under the ImagiNE Nebraska Act.

The amended provisions of LB1400, sponsored by Lincoln Sen. Beau Ballard on behalf of the governor, allow an employer that pays relocation expenses for a qualifying employee to apply to the state Department of Revenue for a refundable state income tax credit of up to $5,000 per employee.

The credit also can be used to offset premium and related retaliatory taxes and franchise taxes.

The committee also advanced a bill intended to help recruit and retain Nebraska National Guard members.

LB1394, sponsored by Sen. Tom Brewer of Gordon at the request of the governor and passed 41-0, allows guard members to exclude certain income — including income received for attending drills, annual training and military schools — from their federal adjusted gross income for state tax purposes beginning with tax year 2025.

A bill modifying Nebraska’s homestead exemption program also advanced from committee.

LB126, introduced last session by Sen. Jen Day of Omaha and passed on a vote of 49-0, allows current homestead exemption recipients to remain eligible for an exemption if a valuation increase pushes the value of their homestead above the allowed maximum.

For homesteads valued at or above the maximum value, the exempt amount will not be reduced and the homestead will remain eligible for an exemption for the current year if it received an exemption in the previous year, was valued below the maximum value in the previous year and is not ineligible for an exemption for any reason other than exceeding the maximum value by at least $20,000.

The exception does not apply if the valuation increase is due to improvements to the homestead.

LB126 includes provisions of LB1151, sponsored by Norfolk Sen. Robert Dover, which update the definition of “occupy” under the homestead exemption program. Under LB126, a departure from a property for health or legal reasons does not disqualify an owner from receiving an exemption so long as they demonstrate an intention to return to the property.

Also included are provisions of LB1019, introduced by Sen. Rick Holdcroft of Bellevue. They require county assessors or clerks to correct the assessment and tax rolls after a final order of an applicable administrative body or court.

Consideration of a proposal to fund additional programs and services with a tax increase on real estate transactions ended on the final round of debate after senators passed over it without taking a vote.

Currently, counties collect a documentary stamp tax at a rate of $2.25 for each $1,000 in value on the transfer of real estate. Counties remit all but 50 cents of each $2.25 collected to the state treasurer, who credits the proceeds to funds related to affordable housing, site development, homeless shelter assistance and behavioral health services.

LB1363, sponsored by Omaha Sen. Mike McDonnell, would have raised the rate to $3.25 for each $1,000 in value and directed the proceeds to several additional uses, including military-related programs, federally qualified health centers and the establishment and operation of an office to pursue and coordinate grant funding on behalf of the state.

The bill was amended to include provisions of LB1067, introduced by Sen. Robert Clements of Elmwood, which would have cut the inheritance tax rate that applies to remote relatives from 11% to 8% and the rate that applies to all other beneficiaries from 15% to 8%.

LB1363 would have allowed counties to retain $1.15 of each $3.25 in documentary stamp tax collected to offset lost inheritance tax revenue.

At McDonnell’s request, Arch passed over the bill. The Legislature moved to the next item on the agenda without voting on LB1363.