Session Review: Banking, Commerce and Insurance

Expanding coverage for cancer screenings, tightening regulations on land purchase transactions and updating banking regulations were among the issues considered by the Banking, Commerce and Insurance Committee this session.

Insurance

LB829, sponsored by Sen. Carol Blood of Bellevue, prohibits insurance plans in Nebraska from charging deductibles, coinsurance or any cost-sharing requirement on a service or item that is an integral part of performing a colorectal cancer screening.

Such services include preparation medications, anesthesia, polyp removal performed during a screening procedure, pathology examinations and specialist consultations.

The bill passed on a 41-5 vote and takes effect Jan. 1, 2025.

LB308, sponsored by Lincoln Sen. Eliot Bostar and passed 43-0, requires express consent from Nebraska residents for the sharing, storage and use of any consumer genetic data by direct-to-consumer genetic testing services.

Under the bill, a direct-to-consumer genetic testing company is required to complete a number of consumer protection prerequisites before disclosing a consumer’s genetic data to third parties. For example, such companies cannot disclose genetic information to any entity offering health, life or long-term care insurance or to an employer without written consent. The measure also requires a process by which consumers can delete their accounts and genetic data.

A measure that would have changed insurance coverage requirements for screening mammography and breast examinations was not advanced from committee.

Under LB1353, sponsored by Sen. Tony Vargas of Omaha, coverage of at least one contrast-enhanced mammogram would have been included in insurance coverage. The bill also would have required coverage of additional mammograms if necessary for women 40 or older.

Omnibus bill

Lawmakers passed an omnibus measure that makes a number of changes to insurance regulation and real estate law in Nebraska.

As introduced by Dunbar Sen. Julie Slama, LB1073 eliminates a requirement that at least one operations review of a third-party administrator within a semiannual review period be conducted onsite. The bill instead gives the director of the state Department of Insurance discretion to require an onsite evaluation if deemed necessary.

The bill contains the provisions of eleven other measures considered by the committee this session.

Provisions of LB446, sponsored by Bostar, provide a regulatory framework for peer-to-peer vehicle sharing in Nebraska and determine the priority of insurance liability. They require that the owner and driver be insured under a motor vehicle liability insurance policy during each sharing period and specify what such a policy must include.

Also sponsored by Bostar, the provisions of LB885 create a lung cancer screening mandate for individuals between 50 and 80 years of age who currently smoke or who quit within the past 15 years and had a 20-pack per year smoking history. The provisions prohibit a deductible, coinsurance or cost-sharing requirement for qualified individuals.

Provisions of LB1136, sponsored by Norfolk Sen. Robert Dover, increase the maximum civil fine that the state Real Estate Commission may impose on an individual performing brokerage activities in Nebraska without a license. The provisions raise the cap from $2,500 per complaint to $5,000 or the total amount of commission earned by the licensee in each transaction subject to a complaint, whichever amount is greater.

Also included in the measure are:

• LB873, sponsored by Lincoln Sen. Beau Ballard, which increases from $500 to $5,000 the amount of “good funds” a person acting as a real estate closing agent must have available for disbursement at the time of closing a real estate transaction;

• LB990, introduced by Bostar, which alters the Pharmacy Benefit Manager Licensure and Regulation Act;

• LB1024, also sponsored by Bostar, which changes provisions related to documents and information provided to an independent review organization under the Health Carrier External Review Act;

• LB1135, introduced by Dover, which prohibits use of right-to-list home sale agreements and changes provisions of the Nebraska Real Estate License Act;

• LB1147, sponsored by Bostar, which provides requirements for separate investment accounts that hold assets of index-linked variable annuity contracts;

• LB1148, introduced by Blair Sen. Ben Hansen, which changes requirements relating to insurance coverage of step therapy for certain drugs;

• LB1227, sponsored by Ballard, which allows a professional employer organization to offer its covered employees any health benefit plan that meets the requirements of the Multiple Employer Welfare Arrangement Act and the federal Employee Retirement Income Security Act; and

• LB1409, introduced by Bostar, which changes provisions of the Nebraska Condominium Act related to notification requirements regarding the subdivision of a unit, creation of timeshares or proposed amendment to a declaration that adversely affects the priority of the mortgagee’s right to foreclose its lien or otherwise materially affects the rights and interests of the mortgagee or beneficiary.

LB1073 passed on a 44-0 vote and took effect immediately.

Other measures

A bill that requires an affidavit for real property purchases near sensitive military areas in Nebraska was approved this session.

LB1120, introduced by Gering Sen. Brian Hardin, requires purchasers of real property that is designated as “covered real estate” under federal law to swear an affidavit stating that they are not affiliated with any foreign government or adversary.

Responsibility for determining whether an affidavit is required rests solely with the purchaser and no individual or entity other than the purchaser will bear civil or criminal liability relating to an affidavit under the bill’s provisions.

Affidavits will be submitted to the register of deeds who will send a copy to the state attorney general. A falsely sworn affidavit is a misdemeanor offense.

The bill passed on a 45-0 vote.

LB1074, introduced by Slama at the request of the state Department of Banking and Finance, amends various areas of state law and the Uniform Commercial Code by adopting updates to federal law relating to banking and finance. The bill also changes provisions relating to credit union examinations, receivership bonds and remedies under the Commodity Code.

The measure includes LB1075, also introduced by Slama, which changes provisions of the Delayed Deposit Services Licensing Act, Nebraska Installment Loan Act, Nebraska Installment Sales Act, Nebraska Money Transmitters Act and the Residential Mortgage Licensing Act.

The provisions update existing requirements for background checks of consumer finance licensees and provide a requirement for those licensees to notify the state Department of Banking and Finance of any data security breaches within three business days.

Also included in the bill are the following:

• LB710, sponsored by Sen. George Dungan of Lincoln, which modernizes and updates the State Credit Union Act;

• LB872, introduced by Elmwood Sen. Robert Clements, which prohibits acceptance of central bank digital currency by state and local governments as a form of payment during financial transactions;

• LB1122, sponsored by Ballard, which changes enforcement provisions relating to written solicitations for financial products or services and increases the fine from $1,000 to $5,000 per violation;

• LB1176, introduced by Dungan, which regulates public entity pooled investments;

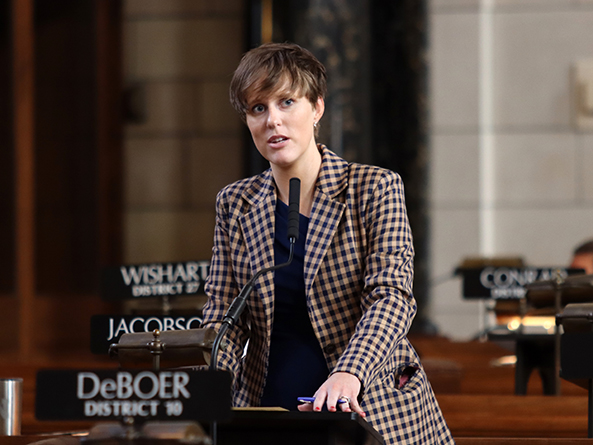

• LB1290, sponsored by Bennington Sen. Wendy DeBoer, which aims to promote the use of special needs trusts by individuals with disabilities; and

• LB1294, introduced by Bostar, which changes provisions relating to data privacy, including certain certificates and information relating to vital records, and provides for certain records to be exempt from public disclosure.

LB1074 passed on a 47-0 vote and took effect immediately.

Finally, the committee did not advance a proposal intended to protect certain hospitals and other health care facilities in Nebraska that purchase drugs at discount prices through a federal program.

LB984, sponsored by Hardin, would have prohibited drug manufacturers or wholesale drug distributors from directly or indirectly denying, restricting, prohibiting, refusing, withholding or otherwise interfering with the acquisition of a 340B drug by any pharmacy that is under contract with a participating entity.