Income tax exclusion for guard members advanced

Lawmakers gave first-round approval Feb. 20 to a bill intended to help recruit and retain Nebraska National Guard members.

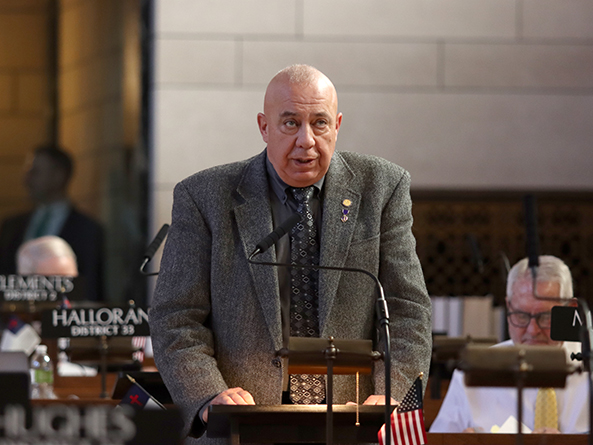

LB1394, sponsored by Sen. Tom Brewer of Gordon at the request of Gov. Jim Pillen, would allow guard members to exclude certain income from their federal adjusted gross income for state tax purposes beginning with tax year 2025.

Brewer said the bill would allow guard members to exclude the income they receive for attending weekend drills and annual training. The change would incentivize more Nebraskans to join the guard, which has struggled in recent years to meet its recruiting goals, he said.

The state Department of Revenue estimates that LB1394 would reduce state general fund revenue by $969,000 in fiscal year 2024-25, $2.2 million in FY2025-26 and $2 million in FY2026-27.

The bill advanced to select file on a vote of 37-0.