Social Security income tax phaseout stalls on second round

A proposal to speed up the eventual elimination of state taxation of Social Security income stalled on select file March 25 after a failed cloture motion.

Lawmakers passed a measure in 2021, sponsored by Omaha Sen. Brett Lindstrom, which set the exemption on such income, to the extent that it is included in federal adjusted gross income, at 20 percent in tax year 2022. The exemption then is scheduled to increase 10 percent per year until reaching 50 percent in tax year 2025.

Lindstrom introduced LB825 this session to accelerate that schedule, resulting in a 100 percent exemption in tax year 2025.

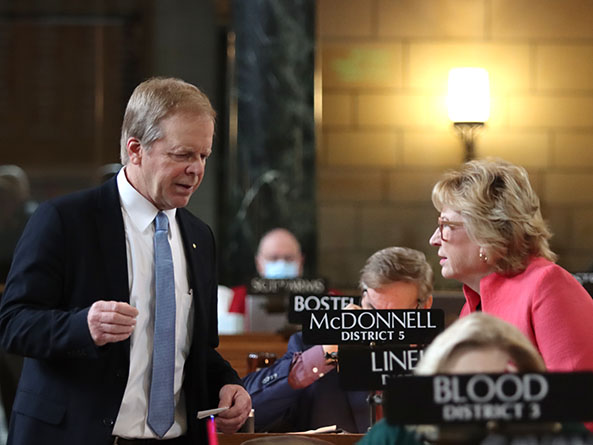

Sen. Tom Briese of Albion introduced an amendment on select file that would include the amended provisions of LB939, introduced by Elkhorn Sen. Lou Ann Linehan.

That proposal would cut Nebraska’s top individual income tax rate in several steps from the current 6.84 percent to 5.84 percent by tax year 2027. It also would cut the state’s top corporate income tax rate from the current 7.5 percent to 5.84 percent by the same year.

The amendment also contains the provisions of LB723, introduced by Briese. That proposal is intended to ensure that a refundable state income tax credit does not fall below its current amount of $548 million. The credit, created in 2021 under LB1107, is based on property taxes paid to schools.

Under Briese’s proposal, the credit amount would increase to $560.7 million for tax year 2023 and then increase by an allowable growth percentage beginning in tax year 2024. The percentage is equal to the growth in statewide real property value and cannot exceed 5 percent in any year.

Briese’s amendment also would create a similar refundable tax credit based on the amount of property taxes paid to a community college.

The total amount of credits this year would be $50 million. It then would increase annually, reaching $195 million during taxable years that begin during calendar year 2026. After that, the total would increase by the allowable growth percentage.

Sen. Wendy DeBoer of Bennington moved to divide Briese’s amendment into four parts. The motion was successful.

Briese said the proposal is a compromise among several lawmakers and that removing any piece would “tank the whole package.” Nebraska has a higher personal income tax rate than any of its neighbors, he said, making it more difficult for the state to attract new residents and businesses.

“Our high marginal rates are not conducive to growing our state,” Briese said.

Lindstrom supported Briese’s proposal, saying Nebraska’s tax rates are far from competitive when compared to neighboring states. He said the proposal would return tax dollars to Nebraska residents at a time when state tax revenues far exceed forecasts.

Linehan also supported the proposal, saying opponents blocked consideration of an earlier version during debate on LB939. Speaker Mike Hilgers of Lincoln pulled the bill from the agenda at Linehan’s request after approximately one hour of second-round debate March 22. It will not be considered again this session, he said.

Linehan said Nebraska’s top personal income tax rate is the highest in the Midwest.

“Even when we get to 5.84 [percent] … we’ll still be too high, in my opinion,” Linehan said. “But it is a good start.”

Also in support was Henderson Sen. Curt Friesen. Although he is not a “big fan” of the proposed corporate tax cut, he said, LB825 and the Briese proposal are a “huge step forward for all taxpayers.”

“This is what compromise looks like,” Friesen said.

Sen. John Stinner of Gering, chairperson of the Appropriations Committee, said LB825 and the Briese proposal would reduce state revenue by approximately $964 million per year once fully implemented.

He said an earlier version of the proposal would have removed the 5 percent cap on the LB1107 credit’s growth rate, but he insisted that it remain. The limit, along with the state’s $1.3 billion cash reserve, would ensure that the tax package would not “crowd out” other state spending or require cuts in a future economic downturn, Stinner said.

Sen. Matt Hansen of Lincoln opposed the Briese proposal. Although he supports LB825, he said, the amendment would tie it to an “egregious” corporate income tax cut that has little support among senators.

After four hours of second-round debate, Lindstrom filed a motion to invoke cloture, which would end debate and force a vote on the bill and any pending amendments. The motion failed on a vote of 32-0. Thirty-three votes were needed.

A failed cloture motion results in debate on a proposal ceasing for the day. LB825 is unlikely to be placed on the agenda again this session.