Proposal to set school tax credit amount clears first round

A state tax credit intended to offset part of Nebraskans’ property tax bills would not fall below its current amount under a bill advanced from general file Jan. 26.

The Nebraska Property Tax Incentive Act, passed in 2020 as part of LB1107, created a refundable income tax credit based on the amount an eligible taxpayer paid in property taxes to their school district during the previous year.

The credit is equal to a percentage set by the state Department of Revenue multiplied by the amount of school district taxes paid.

For the 2021 through 2023 tax years, the credit amount may increase based on growth in state tax receipts and the level of its cash reserve, but the law limits total credits for the 2024 tax year to $375 million.

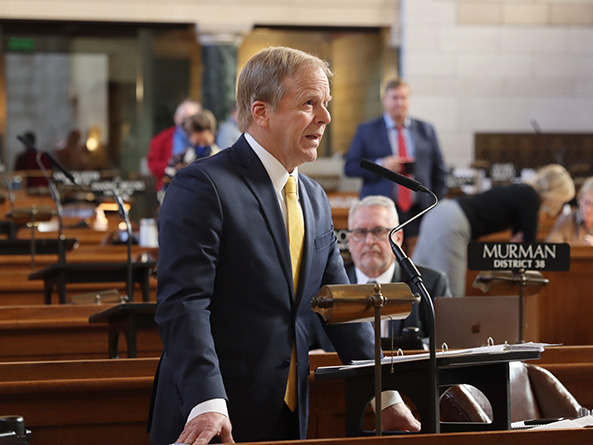

Albion Sen. Tom Briese, sponsor of LB723, said the bill would eliminate the 2024 cap, ensuring that the credit does not drop below its current amount of $548 million, which is an approximately 25 percent rebate on the amount paid in school property taxes.

“If we don’t pass this, we’re signing off on a $200 million property tax increase on each and every homeowner, business owner [and] farmer across the state,” he said.

Under Briese’s proposal, the credit could increase by an allowable growth percentage beginning in tax year 2024 rather than 2025, as currently allowed. The percentage is equal to the growth in statewide real property value and cannot exceed 5 percent in any one year.

Elkhorn Sen. Lou Ann Linehan, chairperson of the Revenue Committee, supported LB723, saying the credit is fair to all property taxpayers and easy to understand.

“We’re not going to, in two years, turn around and tell them all [that] we’re going to not give them back 25 percent of their school taxes,” she said. “That’s just not gonna happen.”

Also in support was Sen. Dave Murman of Glenvil. He said property taxes continue to increase in conjunction with rising property valuations, making the LB1107 credit of “extreme importance” to both agricultural landowners and homeowners.

“We should be talking about increasing property tax relief,” Murman said, “not just trying to maintain the relief that has been finally achieved.”

Gering Sen. John Stinner, chairperson of the Appropriations Committee, supported LB723 but expressed concern that an unexpected surge in state tax revenue over the next two years could increase the credit amount at an unsustainable rate and “squeeze out a whole lot of other initiatives.”

Briese introduced an amendment, adopted 39-0, that he said would prevent such an increase while ensuring that the credit does not fall below its current amount.

The amendment would require the department to set the percentage so that the total amount of credits for tax year 2022 would be $548 million. For tax year 2023, the department would set the percentage so that the credit amount is $560.7 million, which Briese said would match a Legislative Fiscal Office projection.

Sen. Matt Hansen of Lincoln said the credit amount has increased much faster than expected because the state moved its 2020 tax filing deadline in response to the pandemic. This shifted approximately $262 million in tax revenue from fiscal year 2019 to 2020, he said, triggering an increase in the credit amount.

He introduced and later withdrew an amendment that would reset the credit to that lower amount in 2024.

Omaha Sen. Steve Lathrop said the current credit amount also is the result of an influx of federal pandemic relief funding. Such revenue increases do not represent a “new normal,” he said, and lawmakers should not commit the state to a higher credit amount before understanding its current fiscal condition.

Sen. Carol Blood of Bellevue said much of the credit amount went unclaimed last year because the mechanism to do so is difficult to understand.

She introduced an amendment that would replace the bill with provisions of her LB688, under which taxpayers would receive a credit on school taxes levied beginning in 2022. The amendment failed on a vote of 5-27.

Omaha Sen. Machaela Cavanaugh filed a motion to bracket LB723 until March 17. She said this would delay further debate on the bill until after the Nebraska Economic Forecasting Advisory Board releases revenue projections in late February. The motion failed on a vote of 4-28.

Senators then voted 36-0 to advance the bill to select file.