Inheritance tax proposal amended, advanced

A proposal to cut inheritance tax rates and increase exemption amounts advanced to the final round of debate Jan. 20 after lawmakers amended it to ensure step relatives receive the same inheritance tax treatment as beneficiaries who are blood relatives.

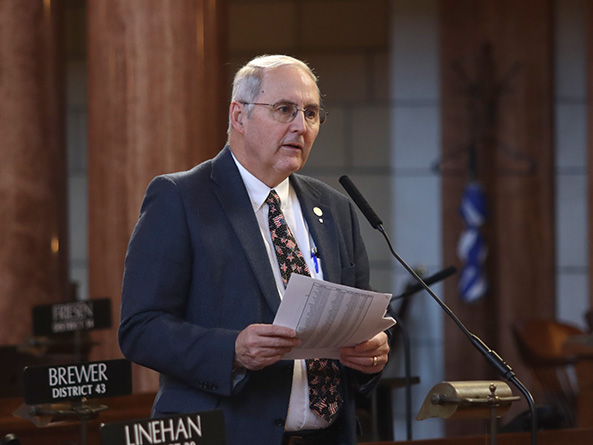

LB310, introduced by Elmwood Sen. Robert Clements, would decrease inheritance tax rates on beneficiaries and increase the amount of property value that is exempt from the tax, which in Nebraska is collected by counties.

Under an amendment Clements introduced on select file, the changes would apply to estates of individuals who die on or after Jan. 1, 2023.

The bill would require county treasurers to compile and submit a report regarding inheritance taxes to the state Department of Revenue.

To help counties complete those reports, the amendment also would require an estate’s personal representative, upon distribution of proceeds from the estate, to submit a report on inheritance taxes to the county treasurer in the county where the estate is administered.

The Clements amendment was adopted on a vote of 38-0.

Sen. Wendy DeBoer of Bennington then introduced an amendment to add provisions of her LB377 that would expand the definition of relatives for purposes of the inheritance tax to include certain step relatives.

DeBoer said there is no good policy reason for the law to make a distinction between beneficiaries who are blood relatives and those who are step relatives.

“This change reflects that the modern family comes in different types and the frequency of these situations is becoming more common,” she said.

After adopting DeBoer’s amendment on a vote of 38-1, senators voted 34-3 to advance LB310 to final reading.