Tax credit scholarship program proposed

Individuals and businesses could claim a state income tax credit for contributions they make to nonprofit organizations that grant scholarships to students who attend private schools under a bill heard Jan. 28 by the Revenue Committee.

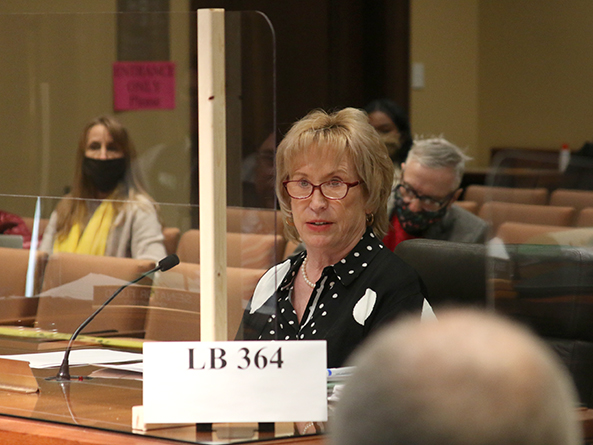

LB364, introduced by Elkhorn Sen. Lou Ann Linehan, would allow individuals, passthrough entities, estates or trusts and corporations to claim a nonrefundable income tax credit of up to 50 percent of the taxpayer’s state income tax liability for the tax year on contributions they make to certain scholarship-granting organizations.

Only Nebraska residents would be eligible for the scholarships, which could be used to pay tuition and fees at a qualifying privately operated elementary or secondary school in Nebraska.

Students would be eligible for the scholarships if, among other requirements, they are a dependent member of a household with a gross income that does not exceed the eligibility guidelines for reduced-price meals under the National School Lunch Program.

Linehan said children who currently are enrolled in a private school would not qualify for the scholarships, which are intended to go only to students whose family income does not exceed 185 percent of the federal poverty level.

“These are not wealthy students,” she said. “These are not even middle-class students — these are low-income students.”

LB364 would allow the state Department of Revenue to grant $10 million in credits in 2022. After that, if at least 90 percent of the credits in any given year are claimed, the annual limit would increase by 25 percent.

Assuming that the limit would increase each year, the department estimates that the bill would reduce state general fund revenue by $10 million in fiscal year 2022-23, $12.5 million in FY2023-24 and $15.6 in FY2024-25.

Suraya Wayne of Omaha testified in support of LB364. She said her son’s education suffered after he was labeled disruptive as a kindergartner while enrolled in Omaha Public Schools. With help from family to pay the tuition, Wayne moved him to St. Cecilia Cathedral School, she said, where individualized instruction has helped him thrive.

“I have seen firsthand a difference in the quality of education provided to my son,” she said. “These are the improvements that can help when a parent has a choice.”

Rick Bettger testified in support of the bill on behalf of three private Catholic schools in Omaha. He said the schools, which primarily serve inner-city students from low-income families, are funded primarily through private donations.

The tax credit scholarship proposed in LB364 could help secure the schools’ financial future and help more students enroll there, Bettger said.

“This bill is about giving families the opportunity to place their children in a school that they feel gives their child a better chance at success,” he said.

Renee Fry, executive director of OpenSky Policy Institute, testified in opposition to the bill, saying the credit would be much more generous than similar programs in other states as well as the existing state tax deduction for other types of charitable contributions.

Fry said the program would divert taxpayer dollars that could be used for public K-12 education to a second, private school system. A better way to help low-income students would be to direct more state funding to public schools in high-poverty areas, she said.

Anne Hunter-Pirtle, executive director of Stand for Schools, also testified in opposition. She said the bill would prohibit scholarship granting organizations from discriminating against students based on race but not religion, gender, sexual orientation, disability and other factors.

If the amount of credits grows by 25 percent per year as allowed under the bill, Hunter-Pirtle said, the program could reduce state revenue by approximately $332 million over the first 10 years.

“I don’t think anyone can seriously suggest that that amount of money will not impact public school funding and … the funding of other state priorities like higher education, health care and public safety,” she said.

The committee took no immediate action on the bill.