Revenue

The Revenue Committee this session advanced a major proposal that includes a new tax credit based on the amount of property taxes paid to a taxpayer’s school district, a new business tax incentive program and a requirement to provide matching funds for a potential project at the University of Nebraska Medical Center.

Tax package

LB1107, introduced by Norfolk Sen. Jim Scheer, contains numerous provisions.

The bill creates a refundable income tax credit based on the amount an eligible taxpayer paid in property taxes to their school district during the previous year, not including those amounts levied for bonded indebtedness or a levy override. The credit is allowed to each individual, business or other entity that pays school district taxes.

For calendar year 2020, the total amount of credits is limited to $125 million. For the following three years, that amount could increase based on growth in the state’s net tax receipts and the level of its cash reserve.

The credit cap will increase to $375 million in 2024. For each year after that, the total amount of credits will be $375 million plus an allowable growth percentage equal to the growth in real property value, not to exceed 5 percent in any one year.

Another provision ensures that the state’s cash reserve could not drop below $500 million after any transfer of funds to the new program.

LB1107 also creates a new business tax incentive program, the ImagiNE Nebraska Act. The application period for the state’s current program, the Nebraska Advantage Act, ends this year.

Sen. Mark Kolterman of Seward introduced the original proposal, LB720, last session. Under LB1107, qualifying businesses will receive a varying combination of incentives based on their level of capital investment and the number of employees they hire at a minimum qualifying wage.

To qualify for sales and use tax incentives under the act, a taxpayer must offer full-time employees the opportunity to enroll in minimum essential health care coverage under an employer-sponsored plan and offer a “sufficient package of benefits.”

The director of the state Department of Economic Development may not approve applications that would include refunds or credits for a calendar year in which a “base authority” is projected to be exceeded.

Base authority is $25 million for calendar years 2021 and 2022, $100 million for 2023 and 2024 and $150 million for 2025.

Beginning in 2026, the director will adjust the base authority every three years to an amount equal to three percent of the state’s general fund net receipts for the most recent fiscal year. Unused base authority will carry forward to the following year, but base authority prior to 2026 may not exceed $400 million.

The bill requires the director and the state tax commissioner to submit an annual report to the Legislature listing the tax incentive agreements signed in the previous year, the agreements still in effect, the identity of each taxpayer who is party to an agreement, the qualified location or locations and other information.

LB1107 also includes the amended provisions of Kolterman’s LB1084, which requires the state to provide $300 million in matching funds for a potential academic hospital and all-hazards disaster response facility at the University of Nebraska Medical Center.

The state will not provide matching funds unless the applicant’s project has been selected for participation in the federal program and $1.3 billion in federal funds and private donations have been received.

In no case will matching funds be transferred before fiscal year 2025-26 or before the total amount of credits granted annually under the Nebraska Property Tax Incentive Act reaches $375 million.

Under LB1107, the state will grant $275 million in credits each year under the Property Tax Credit Relief Act, which uses state sales and income tax revenue to provide Nebraskans with credits meant to offset part of what they pay in local property taxes.

The bill includes provisions meant to encourage “key employers,” or those with at least 1,000 equivalent employees during the base year, to retain jobs in Nebraska when new owners of those companies are considering moving all or some of those jobs out of the state.

LB1107 directs the state Department of Economic Development to create and administer a revolving loan program for workforce training and infrastructure development expenses incurred by ImagiNE Act applicants. It also creates a fund to be administered by the department to provide grants to employers for reimbursement of job training expenses.

Finally, the bill provides a refundable income tax credit to Nebraska businesses that produce renewable chemicals made from agricultural products and repeals a tangible personal property tax exemption.

LB1107 passed on a vote of 41-4.

Property tax

The committee advanced two other proposals meant to reduce local property taxes, but neither mustered enough support to advance from the first round of debate.

LB974, introduced by the committee, would have reduced property valuations for school tax purposes over three years—thereby reducing the amount of property taxes they collect—while increasing state aid to schools via a new foundation aid component. It also included provisions intended to limit school budget and spending growth.

After three hours of general file debate, the Legislature moved to the next item on its agenda without voting on the committee amendment or the bill.

The committee later advanced a modified version of the proposal in the form of a committee amendment to LB1106, also introduced by Scheer. It, too, was taken off the agenda after three hours of first-round debate.

Sales and use tax

A bill that would have turned back a portion of the state sales tax collected on water and sewer services to help cities and utilities pay for infrastructure upgrades stalled on first-round debate.

LB242, as introduced by Omaha Sen. Brett Lindstrom last session, would have required the state to pay each political subdivision, sewer utility or water utility a percentage of the 5.5 percent state sales tax imposed and collected on sewer and potable water fees charged by those entities.

A committee amendment would have replaced the bill and corrected a drafting error regarding the proposed turnback rates.

After three hours of debate over two days, the Legislature moved to the next bill on the agenda before voting on the committee amendment or LB242.

State sales and use tax imposed on the sale or lease of aircraft would have been used to maintain Nebraska’s airports under a bill advanced by the committee on a 6-2 vote.

LB1033, introduced by Sen. Curt Friesen of Henderson, would have required the state tax commissioner to credit an amount equal to the state sales and use tax imposed on the sale or lease of aircraft to a new capital improvement fund administered by the state Department of Transportation.

The bill was not scheduled for first-round debate.

Income tax

Individuals may exclude half of their military retirement benefit pay from state income tax under a bill passed by lawmakers on a vote of 46-0.

Previously, individuals could, within two years after their retirement from the military, choose from two options to exclude military retirement benefit pay from state income tax.

LB153, introduced last session by Gordon Sen. Tom Brewer on behalf of Gov. Pete Ricketts, repeals those options and instead allows individuals to exclude 50 percent of their military retirement benefit income to the extent included in federal adjusted gross income.

The exclusion is for taxable years beginning or deemed to begin on or after Jan. 1, 2022.

Self-employed child care providers may apply for a state income tax credit under a bill approved by lawmakers on a vote of 47-0.

Under the 2016 School Readiness Tax Credit Act, eligible staff members who are employees of child care and early childhood education programs participating in the Step Up to Quality child care program may apply to the department for a refundable state income tax credit of up to $1,500.

LB266, introduced by Lindstrom last session, adds self-employed individuals providing services for eligible child care and early childhood education programs to the definition of “eligible staff member,” allowing them to apply for the credit.

The bill also requires the state Department of Education to include those self-employed individuals in the Nebraska Early Childhood Professional Record System.

Finally, the bill allows credits awarded to passthrough entities to be distributed in the same manner and proportion as income.

Lawmakers voted 47-0 to pass a bill allowing Nebraskans to deduct employer contributions to their state college savings accounts from their state income taxes.

Under LB1042, introduced by Sen. Andrew La Grone of Gretna, an individual’s federal adjusted gross income will be reduced by the amount of any contribution made by the individual’s employer into the individual’s Nebraska educational savings plan trust account.

The deduction is for taxable years beginning on or after Jan. 1, 2021, and may not exceed $5,000 for those married filing separately or $10,000 for other filers.

The bill prohibits any state agency that provides benefits or aid to individuals based on financial need from taking employer contributions into account when determining an individual’s income.

Additionally, LB1042 eliminates the provision in current law that allows only an account’s participant, or registered owner, to take a state income tax deduction equal to contributions they make to their account, within certain limits.

The bill also allows the state treasurer to credit private qualified contributions to the Meadowlark Endowment Fund or to accounts opened under the Meadowlark Program at the direction of the donor.

Lawmakers debated a proposal to decouple Nebraska’s tax code from a federal change intended to help businesses weather the economic effects of the coronavirus pandemic.

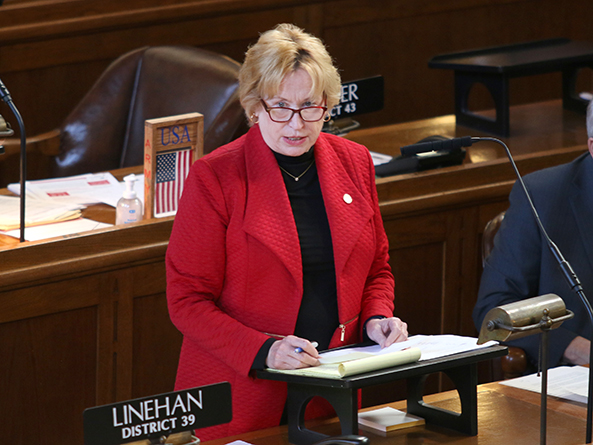

LB1074, sponsored by Elkhorn Sen. Lou Ann Linehan, would have made several technical corrections to state tax law requested by the state Department of Revenue.

Sen. Sue Crawford of Bellevue introduced an amendment on general file that would have decoupled Nebraska’s tax code from a provision in the Coronavirus Aid, Relief and Economic Security Act passed by Congress in March. Because Nebraska conforms to federal tax law on a rolling basis, it automatically incorporates changes made at the federal level.

The provision temporarily removes an excess business loss limitation for passthrough entities, reducing state income tax revenue.

After several hours of general file debate, the Legislature adjourned without voting on Crawford’s amendment or the bill.

The committee advanced another bill that would have allowed taxpayers to direct state income tax refunds to their Nebraska educational savings plan trust accounts.

As amended, LB865, introduced by Omaha Sen. Justin Wayne, would have required the state tax commissioner to include space on the individual income tax return form, beginning with tax year 2021, in which the taxpayer could have designated any amount of a refund as a contribution to their account.

LB865 also would have modified the definition of “matching contribution” for purposes of a program in which the state treasurer provides incentive payments to employers that make matching contributions to employees’ NEST accounts.

Lawmakers voted 38-0 to advance the bill to select file, but it was not scheduled for subsequent debate.

The committee voted 8-0 to advance a proposal to provide an income tax deduction to Nebraska businesses that employ individuals convicted of a felony, but it was not scheduled for general file debate.

Under LB805, also introduced by Wayne, an individual’s federal adjusted gross income—or a corporation’s federal taxable income—would have been reduced by 65 percent of the wages paid to an individual who has been convicted of a felony in any state.