Pillen plan would impose sales taxes to fund property tax relief

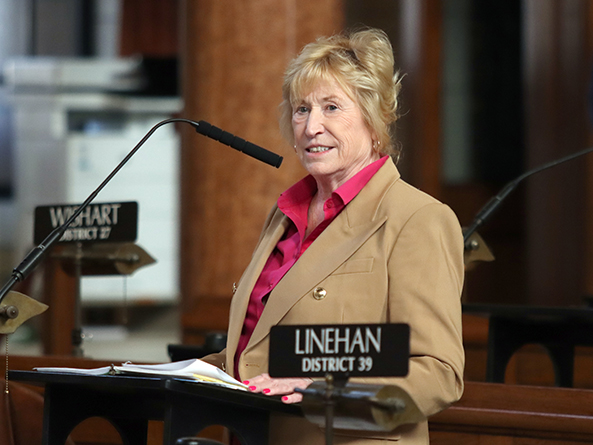

The Revenue Committee heard testimony July 30 on Gov. Jim Pillen’s proposal to increase state sales tax revenue to fund a new tax credit program offsetting property taxes levied by school districts.

Read More