Enhanced tax sale certificate notification requirements advanced

A bill meant to ensure that homeowners receive sufficient notice that they may lose their property due to unpaid taxes advanced from general file March 12.

Currently, counties may sell real property at auction for delinquent taxes. Purchasers pay the delinquent taxes in exchange for a tax sale certificate. After three years, if the property owner has not paid the taxes and any accrued interest, the certificate purchaser may apply for a treasurer’s tax deed to acquire the property.

The purchaser must serve notice to the property owner at least three months before applying for the deed. Among other information, the notice is required to include the amount of taxes represented by the tax sale certificate and a statement that the right of redemption requires payment to the county treasurer.

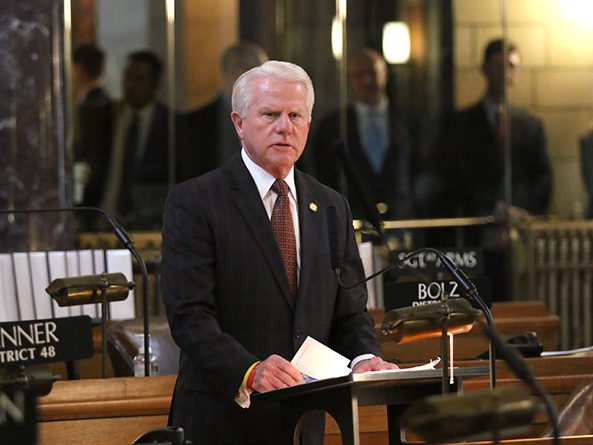

Gothenburg Sen. Matt Williams, sponsor of LB463, said tax sale certificates and the treasurer’s tax deed process ensure that counties and other local taxing entities, such as school districts, receive property taxes due to them. The process begins only after a property owner fails to pay his or her taxes for two or three years, he said.

However, Williams said, current law has led to “inequitable situations” in which property owners did not receive adequate or timely notice that they were at risk of losing their property. LB463 would require tax sale certificate purchasers to make multiple attempts to notify those who occupy the property as well as anyone listed on the property’s title, he said.

Williams said the bill also would require a “checklist” of documents that a tax sale certificate purchaser must provide before a county treasurer issues a tax deed.

Williams introduced an amendment, adopted 31-0, that would apply the bill’s requirements to tax sale certificates sold after Jan. 1, 2017. This would ensure that those certificates are subject to the enhanced notice requirements when they become eligible for the treasurer’s tax deed process in 2020, he said.

Sen. Mike Groene of North Platte supported the bill, saying the enhanced notice requirements would improve the tax deed process.

“Families should not lose their legacy—their inheritance—over delinquent taxes, even though we must … make a firm commitment that you do owe those taxes and you should pay them,” Groene said.

However, Groene suggested that the bill be amended to require counties to include a property owner’s name in an annual list of properties subject to sale due to delinquent taxes, not just a legal description of the property. He said many people would not recognize their property based only on that description.

Elmwood Sen. Robert Clements also supported the bill. He said a couple in his district lost their home and 80-acre farm to a tax sale certificate purchaser after falling behind on their bills and property taxes due to medical problems.

If the notice requirements in LB463 had been in place, Clements said, the man who rented and occupied their land also would have been notified of the delinquent taxes and could have urged the landowners to pay the county.

Lawmakers voted 35-0 to advance the bill to select file.